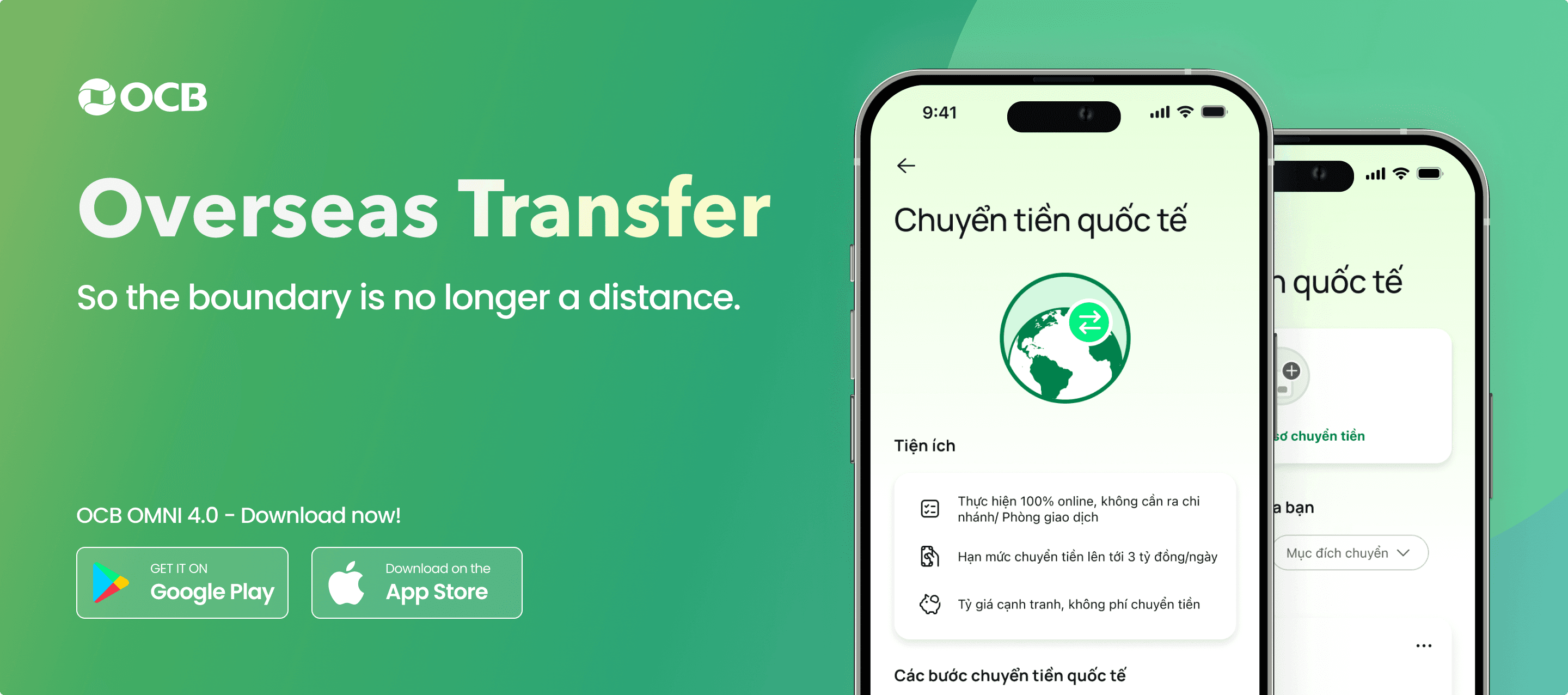

Overseas Transfer

Overview

Designed for high-income individuals who need to send money abroad for their loved ones' education, living expenses, and medical treatment, Overseas Transfer is a feature that includes a profile creation and approval process, followed by international money transfer in multiple currencies with preferential fees.

Unlike other banks like MB Bank, which have a confusing interface and user guidance, OCB's Overseas Transfer offers a seamless experience from profile creation to approval and international transfer through an easy-to-understand interface, step-by-step instructions, automatic information storage, and continuous profile status updates.

My Contribution

UX Research

Clear business with PO

Concepts & Designing UI

Hand-off UI for Dev

User's wishes

Individuals/Organizations who frequently transfer money internationally:

Hai Nam (35 years old): A software engineer working in Hanoi, suddenly needs to send money abroad to support his uncle's surgery. He desires a quick and easy transfer process.

Ms. Lan (50 years old): A housewife whose daughter is studying abroad in Australia. She regularly transfers money to cover tuition and living expenses. She is concerned about exchange rates and transfer fees, as well as the security and safety of the transactions.

ABC Company: An agricultural export company that regularly makes payments to foreign partners. They need an international money transfer solution that supports multiple currencies and provides detailed transaction reports.

The challenge

A. Complex process

Multiple information collection: International money transfer requires a lot of information from users, including:

Sender's information, account number/IBAN, receiving bank, country, currency, purpose of transfer...

Various complex documents need to be provided for the profile review process, which users may not have or may not be prepared to provide immediately at the time of creation.

Effectively collecting and verifying all of this information without discouraging users is a major challenge.

Regulations on profile review: OCB must comply with various legal regulations on international money transfers. If the information you provide does not meet these regulations, the bank may reject your profile from the outset and this can lead to a disjointed user experience.

B. Fluctuating exchange rates and fees

Exchange rates are constantly changing, and there are various fees that can affect the amount the recipient actually receives as well as the amount the sender actually has to pay. How to display exchange rates and fees in a transparent and easy-to-understand manner is an important issue.

UX solution

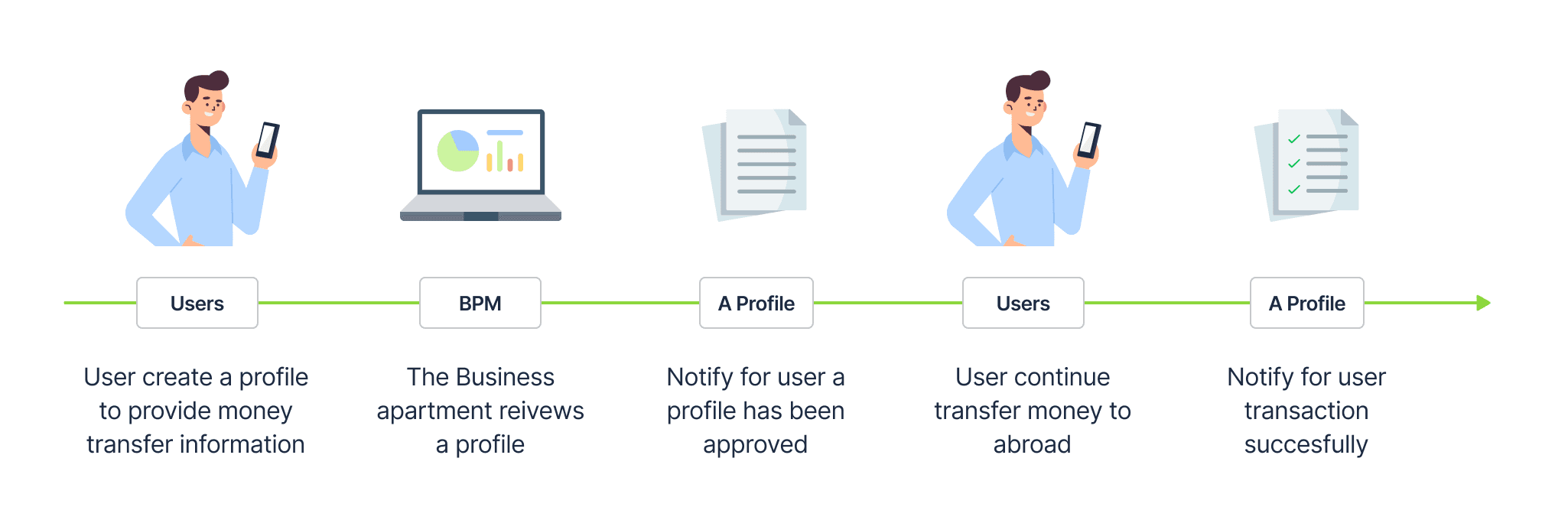

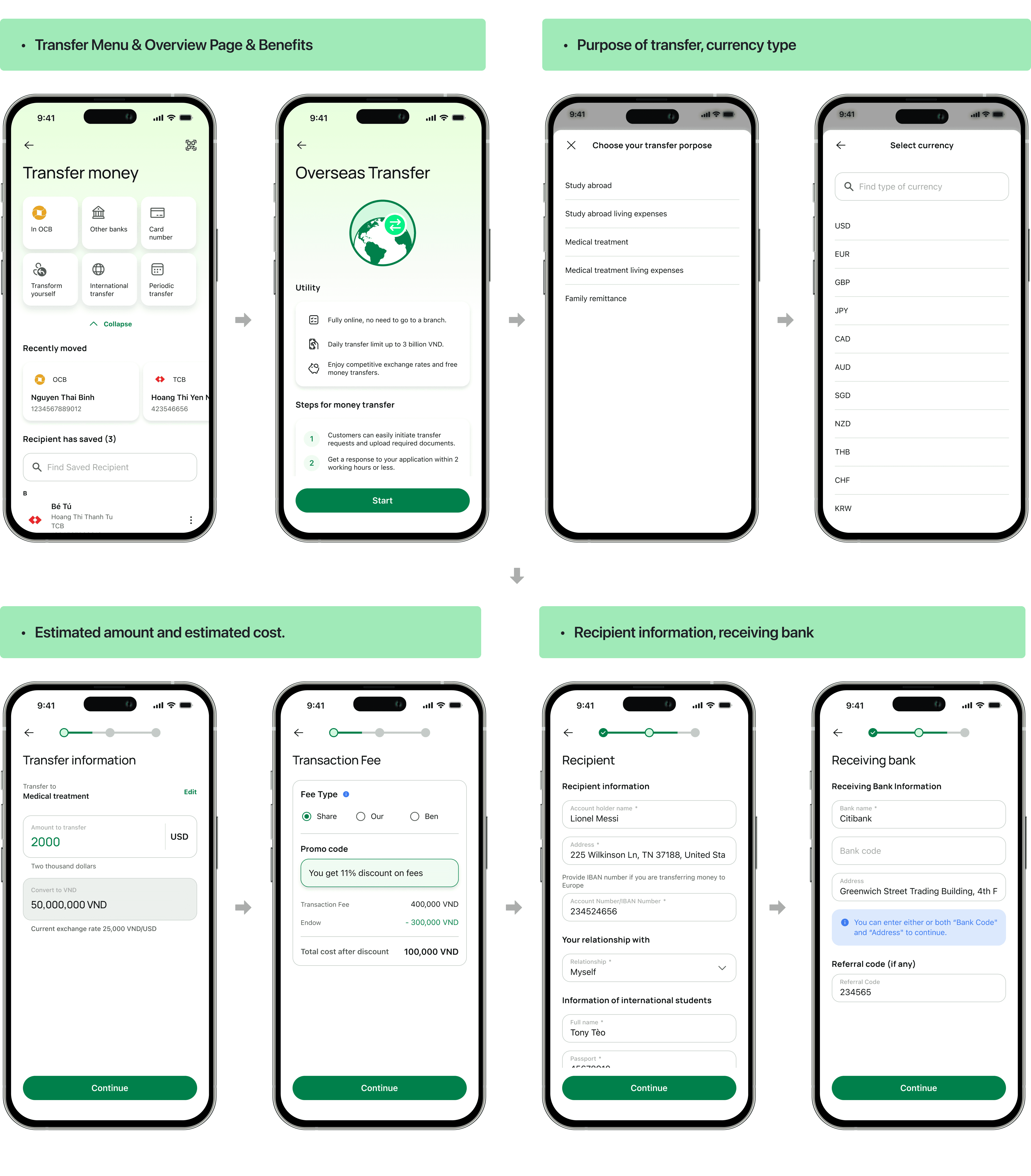

A. Step-by-step process guidance

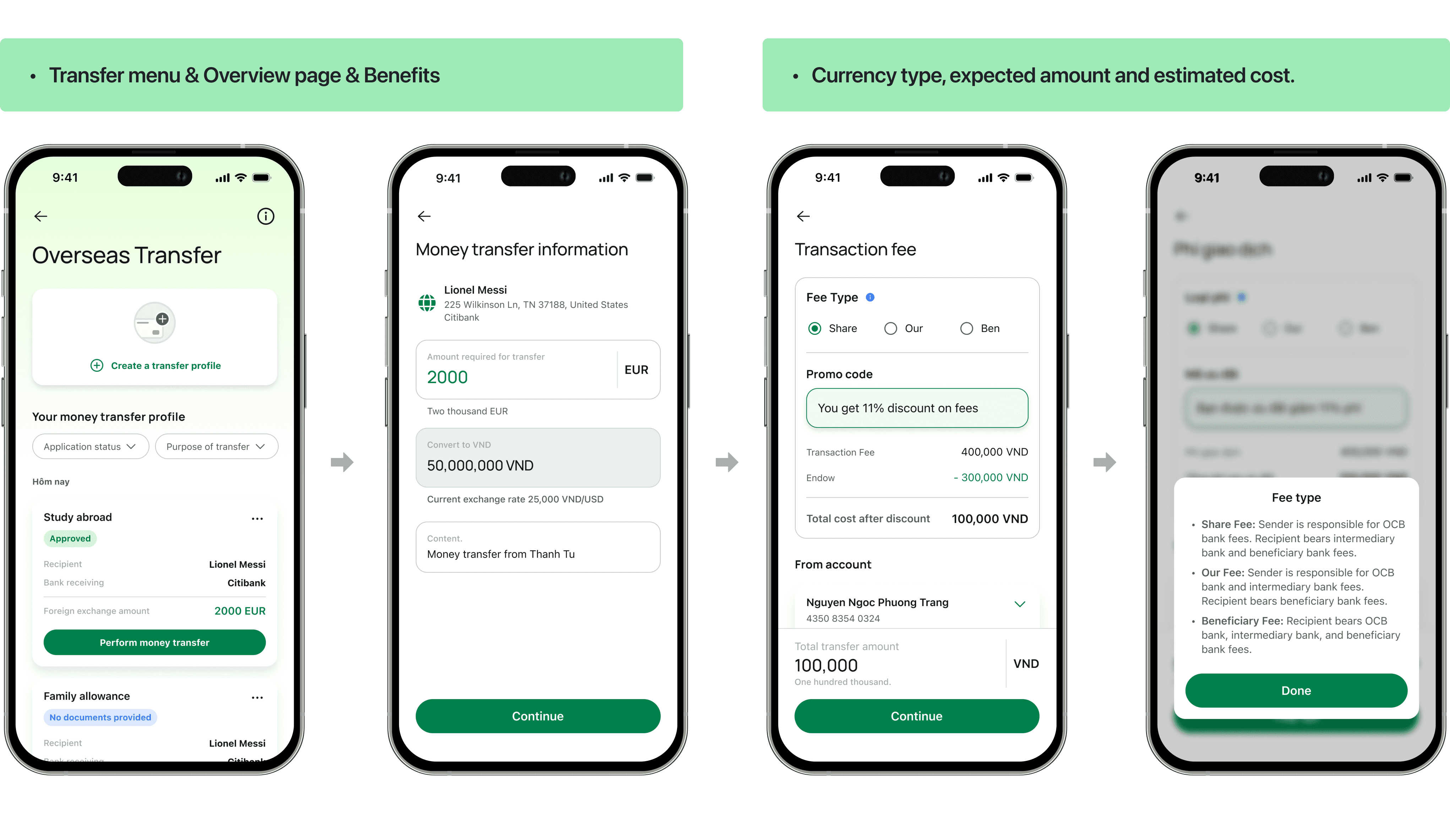

Break down the process of create a money transfer profile (providing information) into clear steps such as:

Overview and basic instructions for international money transfer.

Purpose of transfer, currency, estimated amount and estimated cost.

Information about the sender and receiver.

A visual progress bar helps user easily track the progress of each step.

The auto-save feature after each important step ensures that your information is always secure and you can continue to complete your profile at any time without having to re-enter it from the beginning.

Review information, add supporting documents, and submit the profile.

After providing the information, the profile will be automatically backed up, users can comfortably return to add documents at any time. For the convenience of users to prepare, we have listed the necessary documents based on the purpose of the user's transfer.

For documents that are difficult to prepare immediately, such as VISA, we will allow users to add them later so as not to affect the transfer.

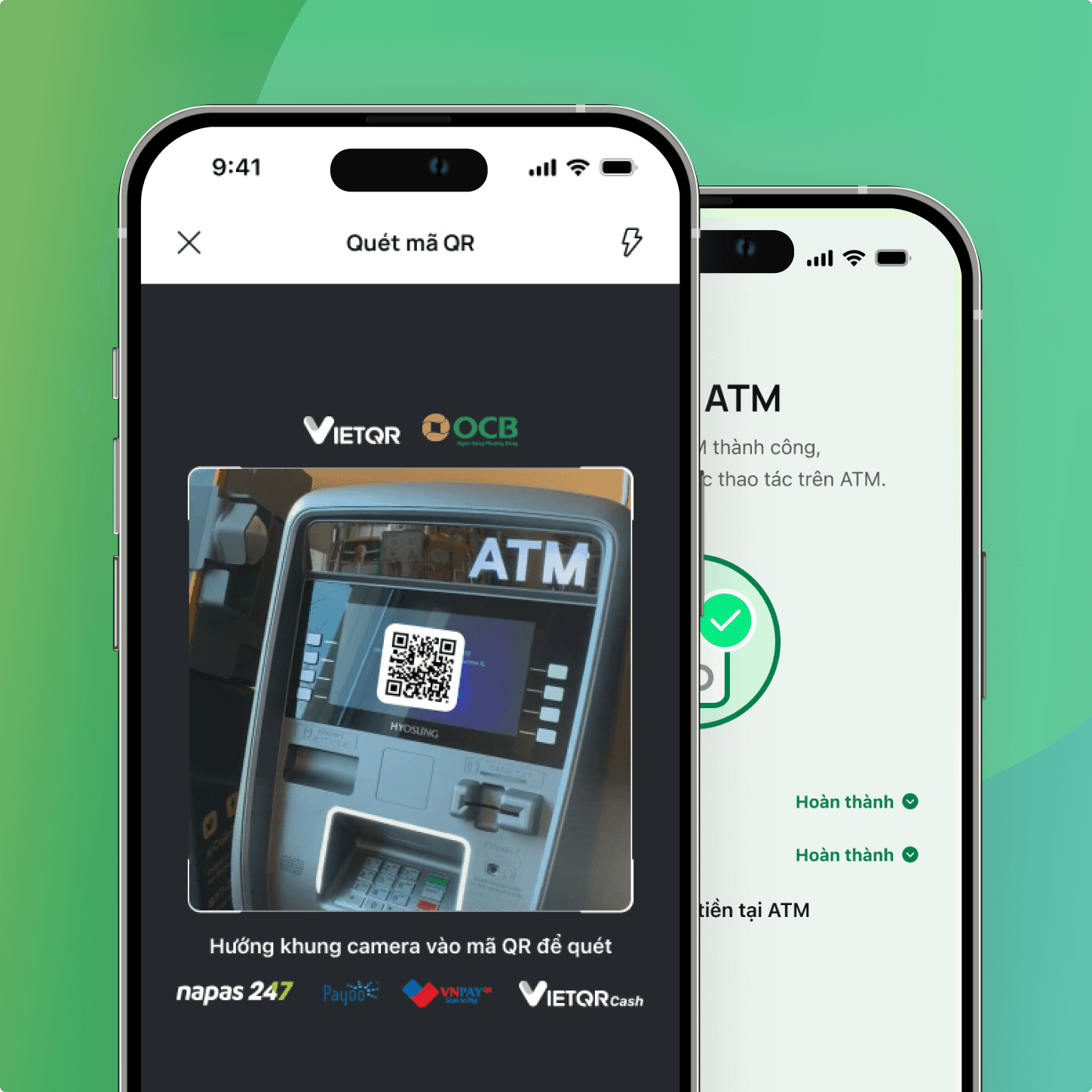

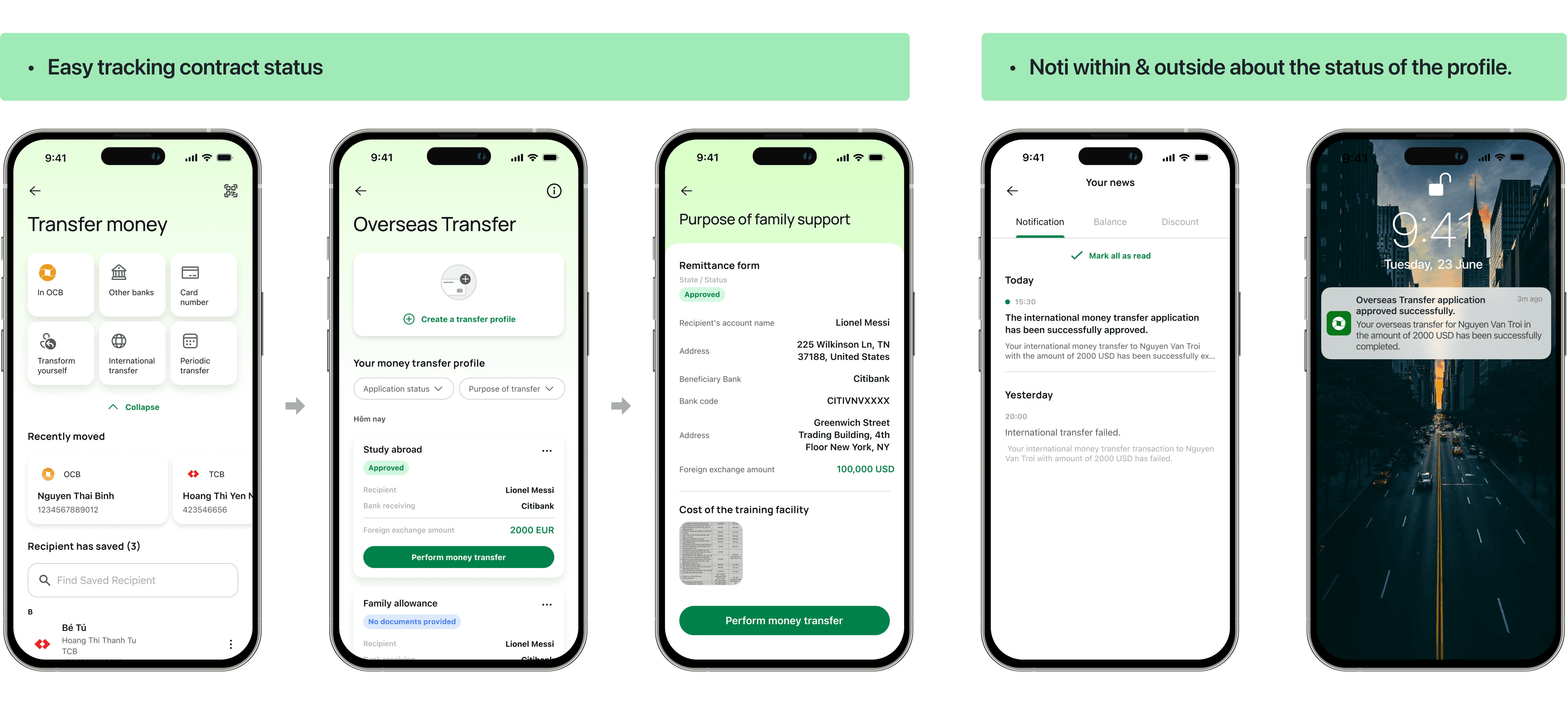

B. Easy profile status tracking

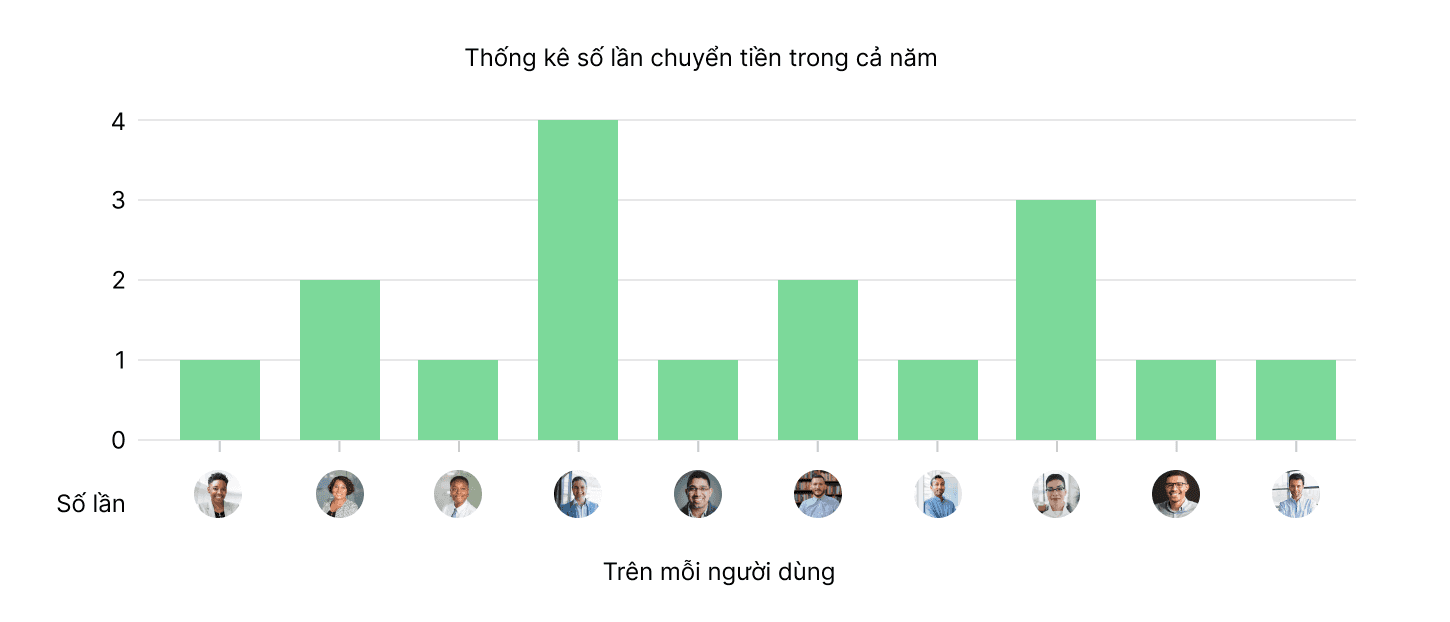

Based on actual data on the number of international money transfers per user per year, most of them are not many, so we can design each profile card with CTA buttons without fear of cluttering the UI.

The profile list page interface is clearly designed for each profile status (successful, failed, additional information required...) after being approved by the International Payment Department.

In addition, the system will send notifications about all profile statuses via in-app and out-of-app notifications and other communication channels, helping users easily grasp information quickly to transfer money internationally.

C. Clarity on exchange rates and fees

After your transfer profile is approved, you can start transferring money abroad and the UI must show:

Exchange rate: This rate applies to the currency in your account and the currency you want to transfer.

Fees: Details of the fees and detailed notes related to the money transfer transaction.

Promotions: Promotions that you are entitled to (if any).

Total amount: The total amount you need to pay, including the transfer amount and all fees (after deducting promotions).

As a result, you will know the actual amount that will be transferred.

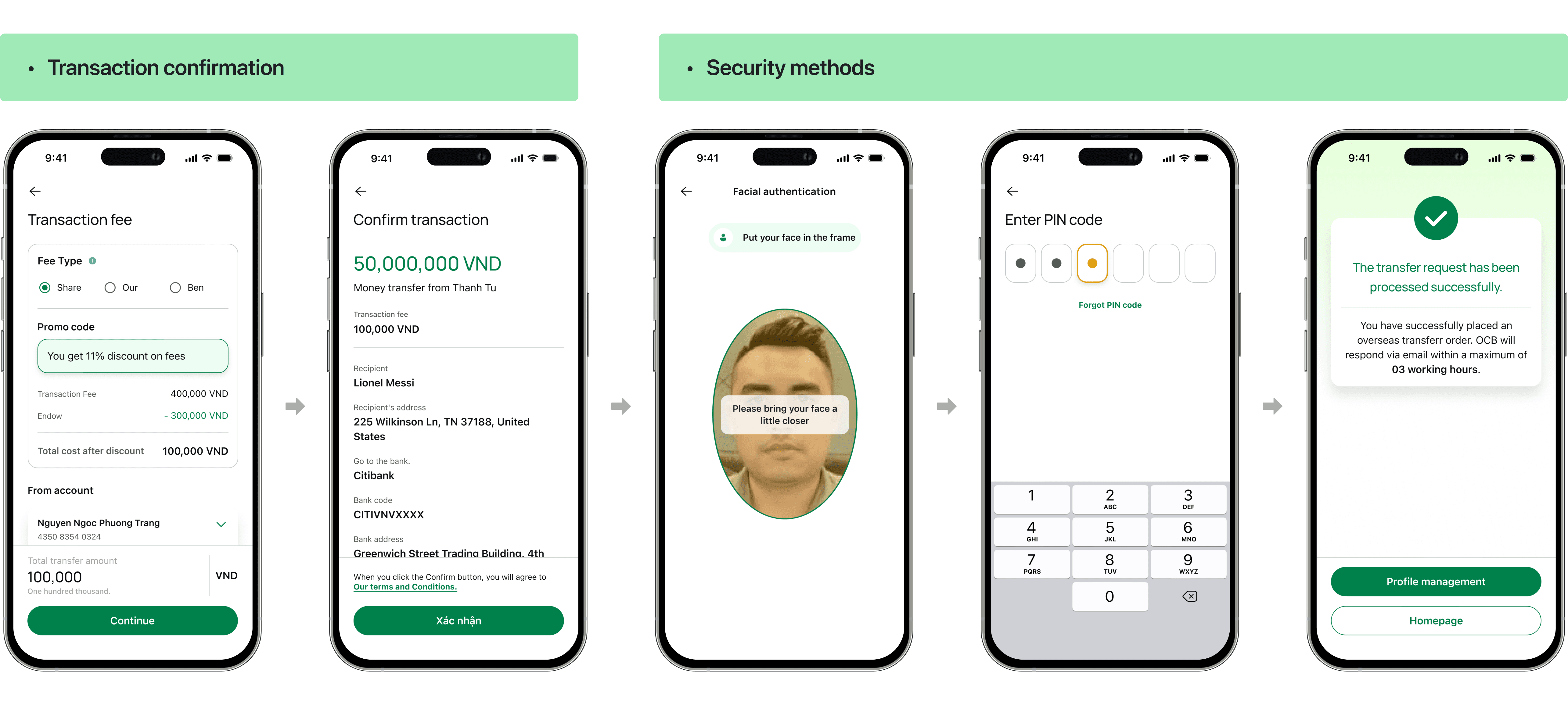

D. Security when making transactions

For amounts over 10 million/transaction, it is mandatory to use the facial recognition authentication method according to the regulations of the State Bank of Vietnam, along with smart OTP authentication methods (biometrics according to the device, and unlock code) to ensure the transaction is authentic and safe for users.

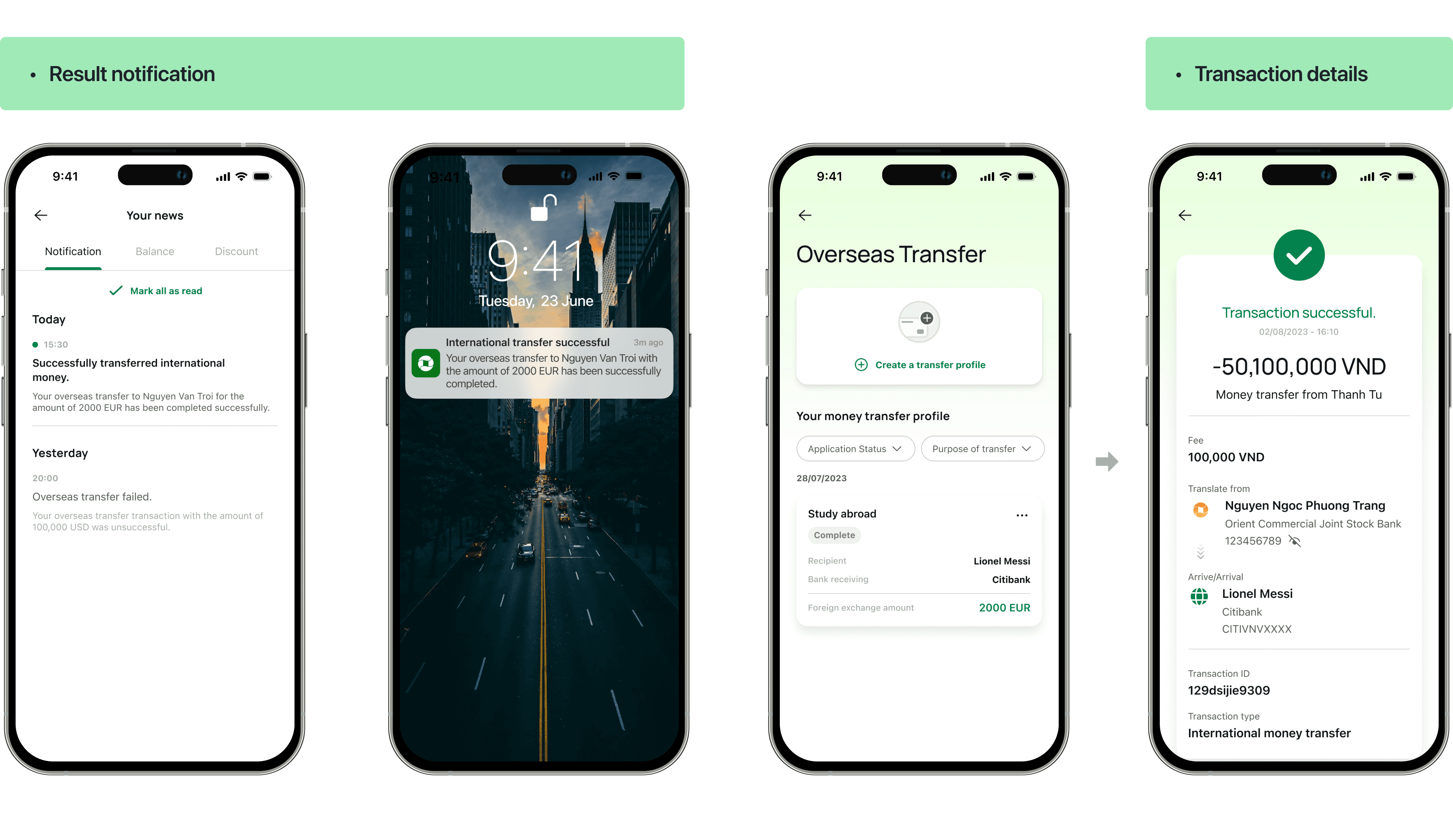

E. Transaction status & detailed report

Notify users of successful/failed transfer status.

Transaction history clearly shows fees, transaction processing time, and other important information so that users can make informed decisions.

2024

Have a good trip 😉