ATM QR Cash

Overview

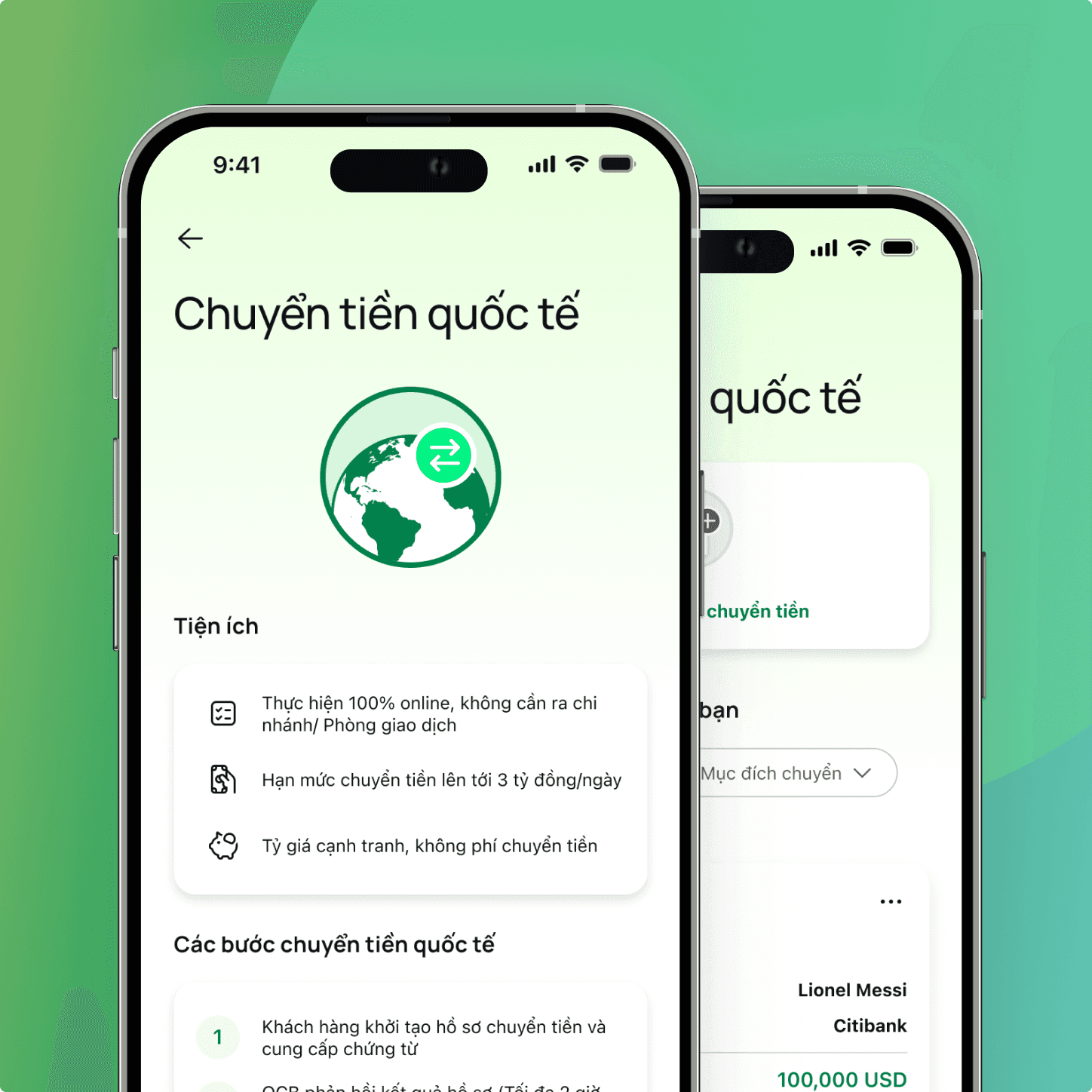

For those who want to withdraw cash quickly without needing a card or when they forget their card, ATM QR Cash is a feature by OCB in partnership with NAPAS. It enables cash withdrawals at ATMs using VietQRCash codes through the OCB OMNI app.

Unlike other banks that require a physical ATM card for cash withdrawals, ATM QR Cash allows users to connect to an ATM quickly and select the withdrawal amount without needing a physical card.

My Contribution

UX Research

Clear business with PO

Concepts & Designing UI

Hand-off UI for Dev

User's wishes

Minh Anh (28 years old): A young and active office worker who often uses mobile apps for her daily tasks. She usually forgets to bring her wallet and bank cards, so the QR code withdrawal feature on the banking app makes it easier for her to get cash when she needs it.

Uncle Hoang (55 years old): A small business owner who isn’t very good with technology but wants simple and safe ways to manage his money. He cares about keeping his card PIN secure and likes the idea of withdrawing cash without worrying about losing his card or leaking his information.

The challenge

A. Changing user habits

Habits of using physical cards: Users are accustomed to using ATM cards for cash withdrawals, so switching to QR codes might feel unfamiliar and disrupt their usual flow.

Concerns about new technology: Some users, especially older adults, may not be familiar with using mobile apps and scanning QR codes.

B. Integration with the existing ATM system

Hardware and software upgrades: The ATM system needs to be upgraded to support the QR code scanning feature.

Ensuring compatibility: Ensure compatibility between the banking app and ATM systems across different banks.

UX solution

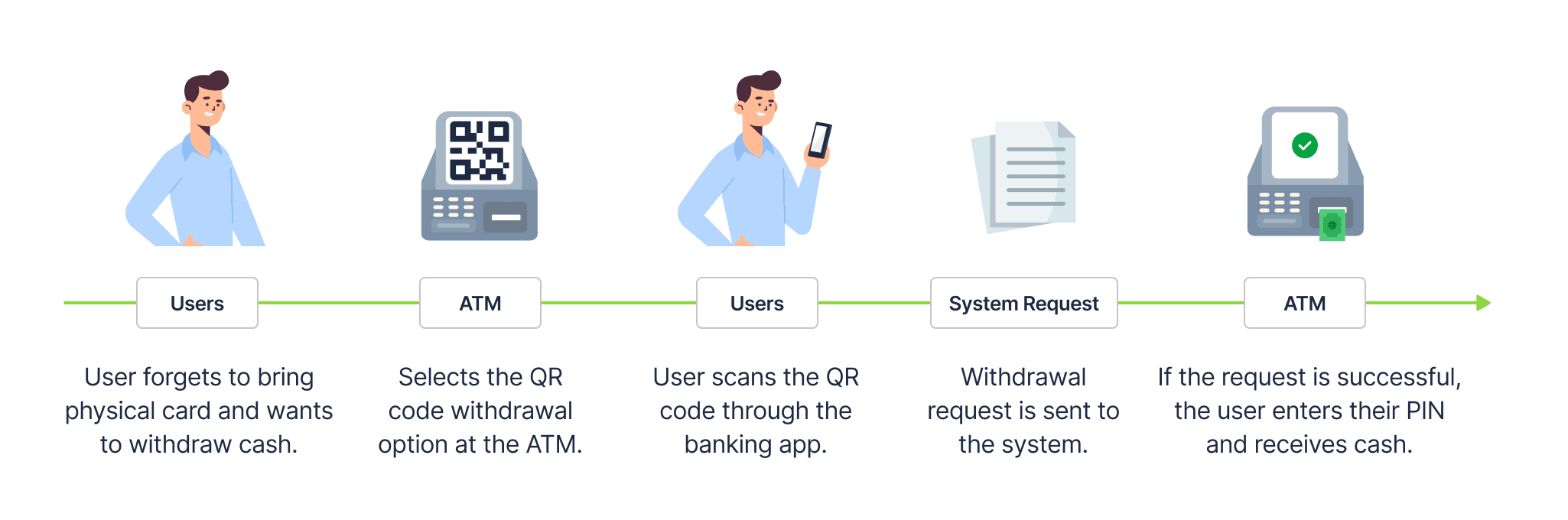

A. Connecting ATMs with the banking app via QR codes

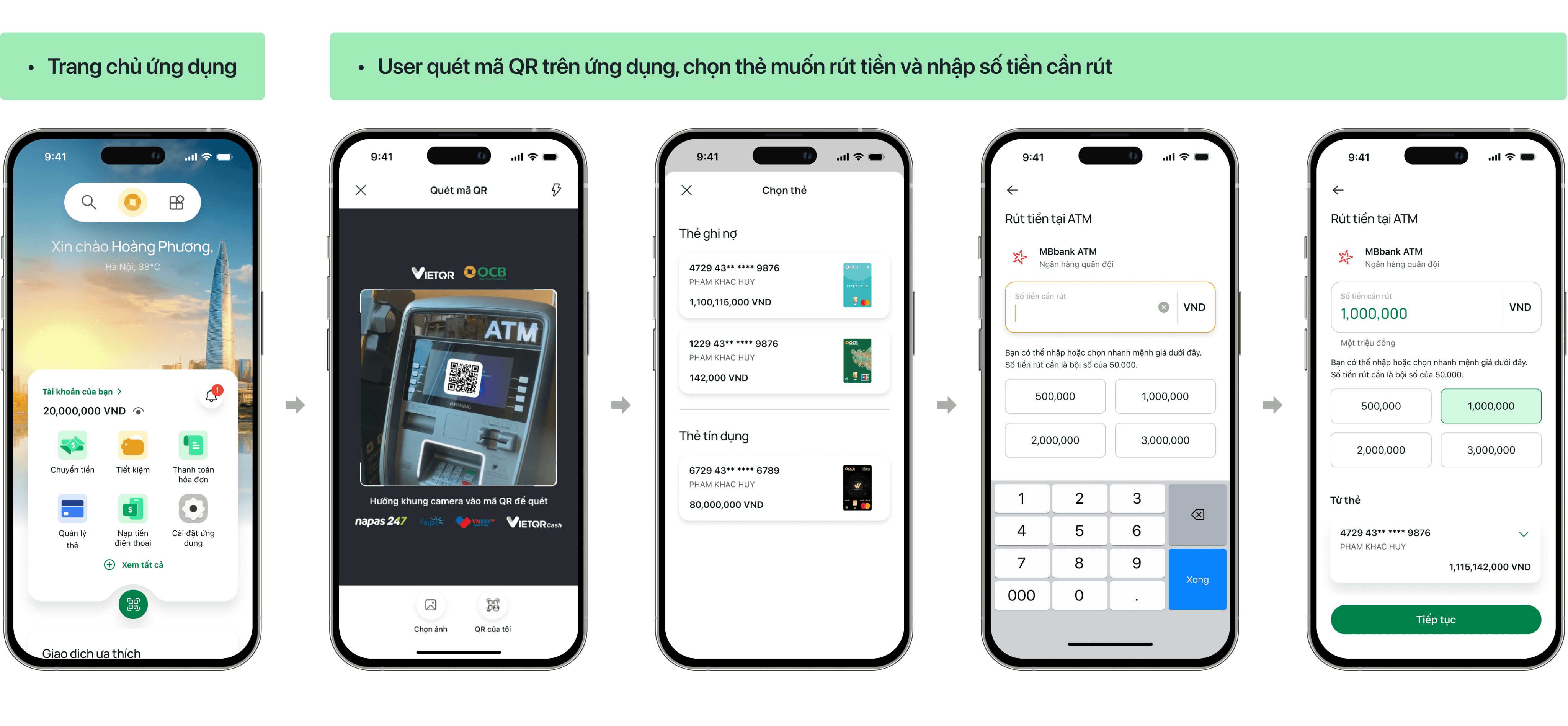

Main screen of the app: Add a clear button or icon for quick access to the QR code scanning feature.

QR code scanning screen: Clearly display the QR code on the ATM with instructions for scanning and notify users if the scan fails.

Source account selection screen: Clearly list debit and credit cards linked to the user's physical cards.

Amount entry screen: Allow users to input any amount or choose from suggested denominations.

Transaction confirmation screen: Clearly display information about the amount, fees, source account, and destination account.

Notifications: Send alerts to users when the connection to the ATM is successful or fails.

Continue withdrawal at ATM: After the system successfully sends the request to the ATM, the ATM will display a screen for the user to enter their PIN and collect cash from the machine.

2024

Have a good trip 😉